TechEnabled RIA Savvy Wealth Raises $11M From Venture Capitalists

Savvy Wealth, a New York-based registered investment advisor that develops proprietary technology, has raised $11 million in a Series A-1 funding round led by Berkeley, California-based The House Fund. Venture capital firms Index Ventures and Thrive Capital, which participated in Savvy's seed round, also invested in the round, as did new investor Brewer Lane Ventures. In the last round, the RIA's total funding was $18 million.

Savvy Wealth was founded in July 2021 by technology entrepreneur Hrithik Malhotra to create a digital platform for financial advisors with a focus on modernizing financial advice for individuals. To date, the firm has hired BNY Mellon, Merrill Lynch, Morgan Stanley and five independent RIA advisors.

"As far as we think of ourselves, we are a technology-based asset management company," Malhotra said. "We're bringing together experienced financial advisors, offering our proprietary technology, sales and marketing automation, a complete 360-view to give advisors a truly richer digital experience, empower end clients and deliver better advice. And better overall service."

The fund will be used to invest in technological development, as well as to hire and acquire small consulting companies.

"We raised this money intentionally because we believe this technology needs to be developed in-house because it helps us really change or improve the way these financial advisors do their jobs," Malhotra said. "It is not enough for us to buy off-the-shelf software and use it as a one-time solution, because a financial advisor works with our clients every day, works with new clients, manages investments, etc. We really wanted to offer this holistic platform."

Malhotra also wanted to address one of the biggest problems facing independent consultants: dealing with mergers. Many software solutions do not work well with each other. He gives the example of one of his investors who runs his own RIA.

"He was smart enough to integrate a bunch of technology, but actually when we asked him what he spends his time on, he said that every week he spends 40% to 50% of his time synchronizing data between different systems. . . making sure everything is in sync," Malhotra said. "Of course, it's very expressive."

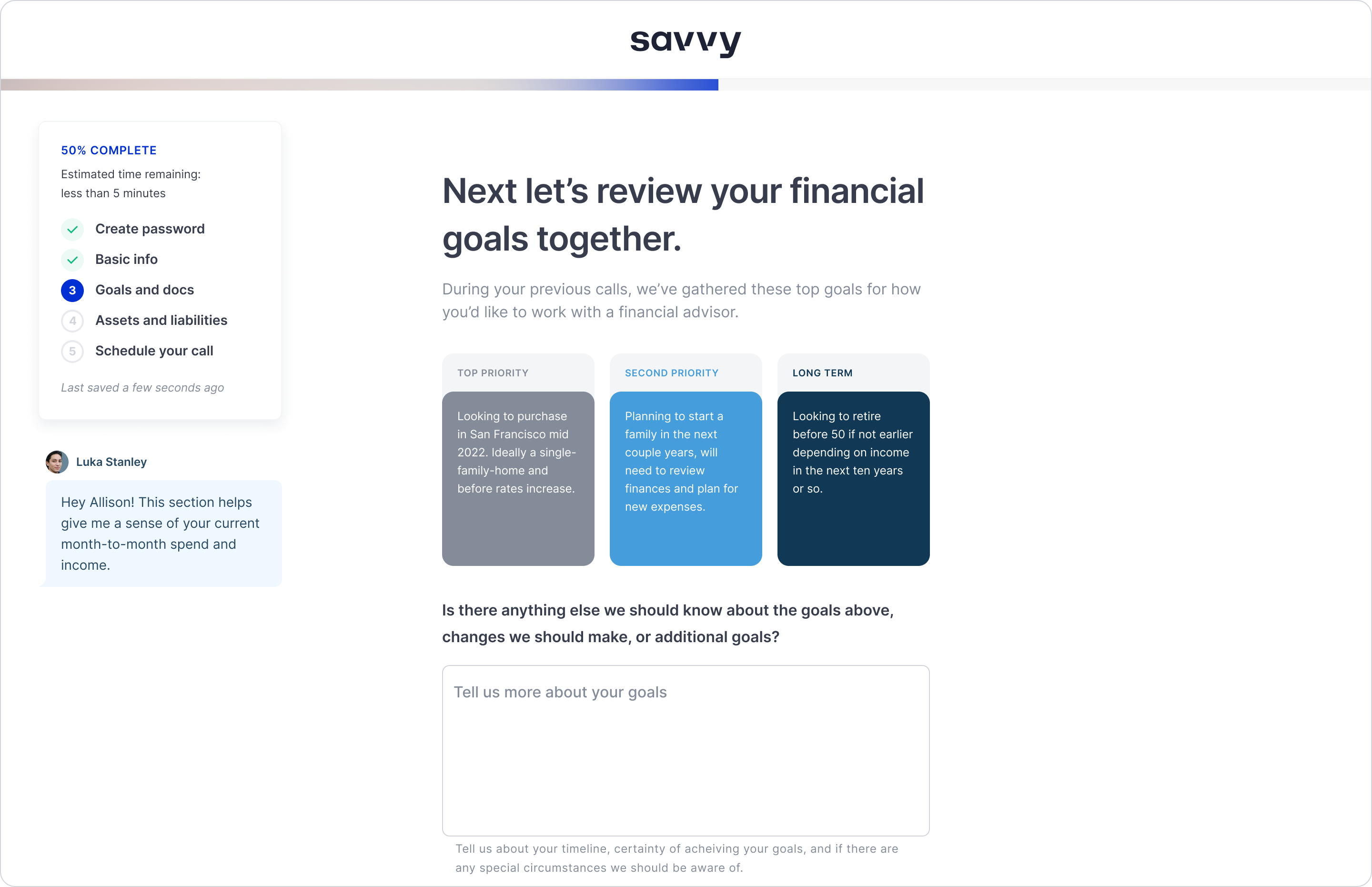

Malhotra's vision is to create a one-stop shop for all consulting technologies, including customer onboarding, workflow management and customer portal. The company is also working on a direct-to-consumer lead generation tool.

Historically, little venture capital has invested in asset management firms, although many have focused on fintech startups such as digital asset managers and robo-advisors. In contrast, private equity firms have invested heavily in asset management.

But Angie Harbers, founder and CEO of Harbers & Company, a financial management consulting firm, said that has started to change in recent years as more venture capital pours into the space.

“Private investment used to facilitate succession planning and/or growth, but now we're seeing a lot of digital innovation, which I would attribute to young startup companies developing proprietary software. Financial planning or asset management or specific problems of integrated software," said Harbers. " Venture capital firms are interested in companies, especially early stage companies. This is exciting because, with the advent of venture capital firms, we see independent financial advice as a valuable investment for future growth.

Earlier this year we saw another example of this with the launch of Compound, a new asset management company that combines human consulting and technology insights. The company has come out of hiding to announce $37 million in venture capital funding led by Greenoaks Capital and angel investor Lacey Groome.

In his conversations with venture capitalists, Malhotra says he compares the business models and companies with established venture capitalists to other "tech services companies," for example. They have already researched insurance sites and real estate brokers.

" [Vegetarian startup companies] have seen a lot of opportunities for, shall we say, more traditional services that add these technology levers into the mix," he said. "So we could create similar stories. And the story is, if we create a technology that really improves the productivity or the experience of each of these financial advisors and helps them free up more time and grow their business to make more money, then we have something else. "

He says venture capital firms provide more permanent capital than private equity firms, with terms of 10 to 15 years.

Rohan Malhotra, general partner at Boston-based Brewer Lane Ventures, one of Savi's investors (no relation to Hrithik), said his firm has invested in some of these high-end service companies, such as insurance companies and banks, working they are in a modern way. . . . They do business.

" For us, Savvy is a neo-modern asset management company," he said. "And the reason you do that is because you believe that the strength of the functions or the innovation functions in those organizations can be combined. This results in better lead generation and interfaces, as well as better prospecting and back office. . The ability to automate something. Together, they make the organization much more efficient."

Brewer Lane also sees an opportunity to benefit from greater macroeconomic headwinds associated with greater wealth shifts, with trillion-dollar inheritances for millennials by 2030.

"We start to understand the consumer experience through the macro lens and we believe there is a better way to do it," Rohan said. “It's moving quickly to consultants realizing that a large part of their work is not focused on what they need to do. And here technology overtakes us. Providing these skills is the first step in building a technology consulting company.'

Jeremy Fiance, a founder and managing partner of The House Fund, another savvy investor, said his firm believes the future of financial advice for the wealthy will be people-centric and technology-driven. They see an opportunity to bring technology to an industry that is still largely based on traditional paper.

" Anyone who has worked with a financial advisor at a traditional firm in 2022 probably knows what I'm talking about: the sign-up process is slow, account transfers are painful, and wet signatures are still sent and received by regular mail." - Groom he said

Rudy Adolph, CEO of Focus Financial Partners, said he is skeptical that venture capital will replace asset management.

"I think there's a strong ecosystem of specialized technology providers -- CRM vendors like Orion, The Adapares, Envestnet, etc., or other vendors like PractiFi, etc. I'm very happy with the technology selection and skill set, but I think I'd prefer technologists and consultants to be," he said.